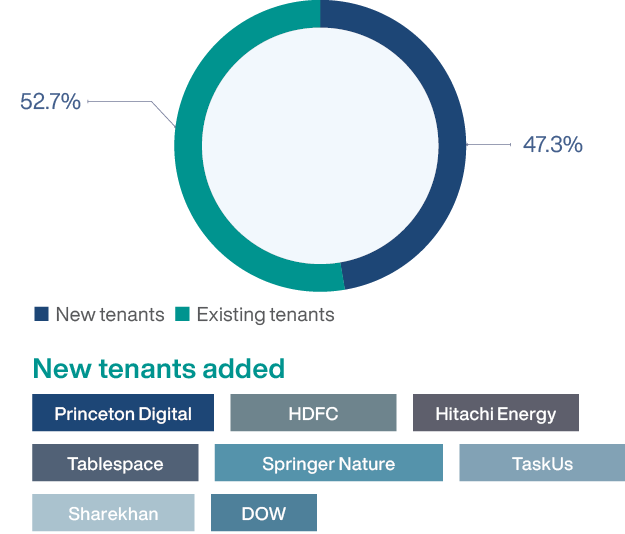

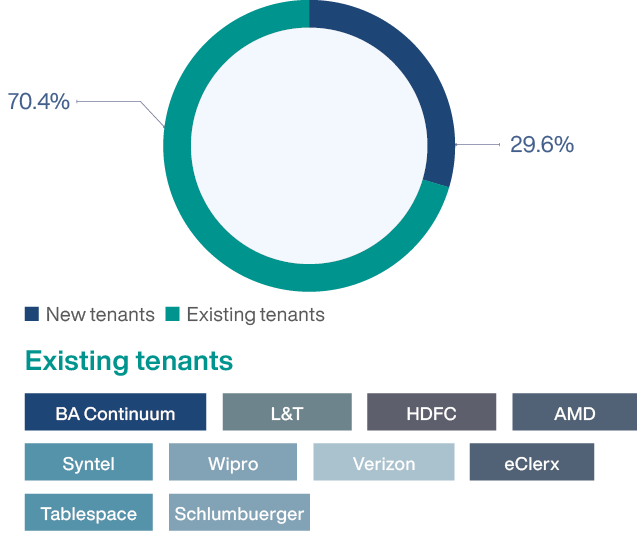

LEASING HIGHLIGHTS

Fostering Tenant Relationships and Expanding Tenant Base

Mindspace REIT nurtures and strengthens tenant relationships through regular interactions, responsive service, and tailored relationship initiatives. Our teams work to constantly meet the evolving needs of our tenants, ensuring their satisfaction, thus building long-lasting partnerships.