Mindspace REIT continues to focus on healthy portfolio occupancy, sustainable rental income and longterm value creation. Anchored by a well-diversified portfolio with key best-in-class assets and stable cash flows from high-quality tenants, it remains resilient and is well-positioned to ride through further economic cycles.

As of March 31, 2023, the Committed Occupancy of the portfolio was up by 470 bps y-o-y to 89.0% due to the increase in Committed Occupancy at Mindspace Madhapur, Mindspace Airoli East and Commerzone Porur.

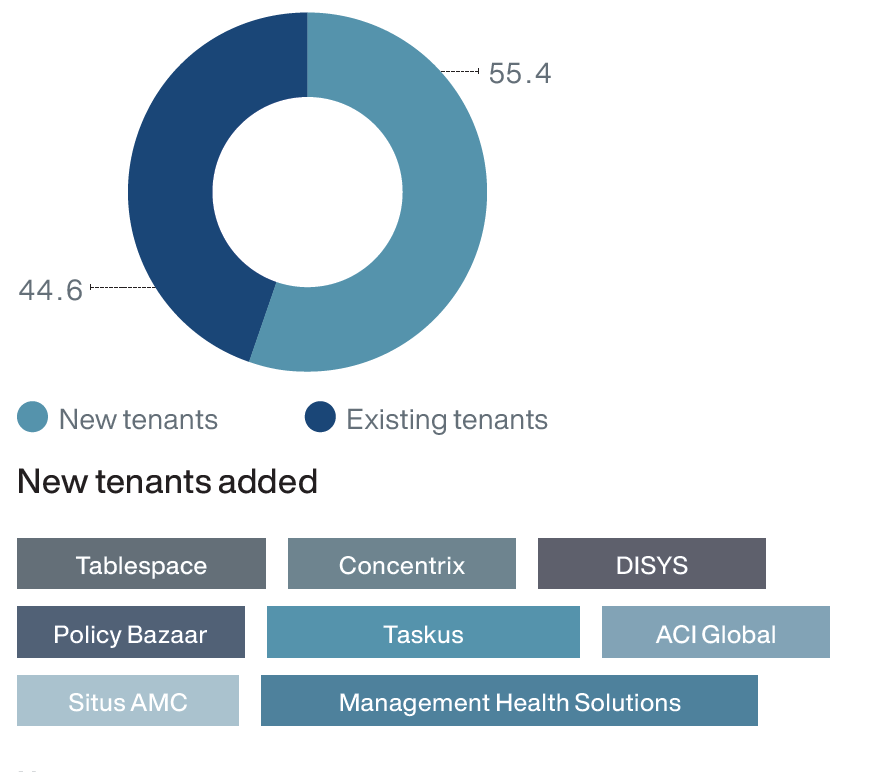

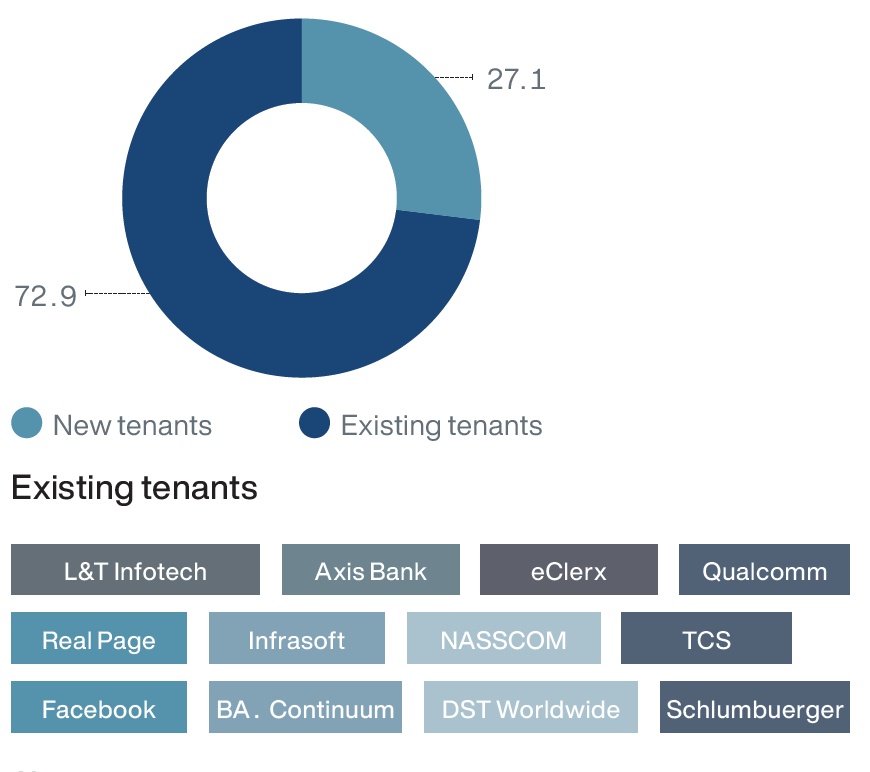

The portfolio remained stable with 200+ tenants as of March 31, 2023. We signed 4.1 msf leases across 83 tenants at an average rent of INR 66 psf during FY23. It includes c. 1.6 msf of new area leasing at around market rents, and c. 2.5 msf vacant area lease and re‑leasing at 26.3% re-leasing spread; 61.7% of our gross leasing was to existing tenants while the balance 38.3% was to new tenants. We retained 81% of tenants whose leases expired during the financial year. Approximately 11%, or 2.7 msf, of leases are set to expire in the next two years. We commence lease renewal negotiations with our tenants well in advance before the expiry of their leases, as this gives us enough time to secure a replacement if the existing tenant does not wish to renew.

Leases signed in FY23

| Tenant | Asset | Location | Area Leased (msf) |

|---|---|---|---|

| Highradius Technologies Pvt Ltd | Mindspace Madhapur | Hyderabad | 0.4 |

| Larsen & Toubro Infotech Limited | Mindspace Airoli East | Mumbai Region | 0.3 |

| BFSI Tenant | Commerzone Porur | Chennai | 0.3 |

| Technology Services Company | Commerzone Porur | Chennai | 0.2 |

| Axis Bank Ltd | Mindspace Airoli West | Mumbai Region | 0.2 |

| BP Business Solutions India Pvt Ltd. | Commerzone Kharadi | Pune | 0.2 |

| Tata Consultancy Services Ltd | Commerzone Yerwada | Pune | 0.2 |

| Tablespace Technologies Pvt. Ltd. | Mindspace Airoli West | Mumbai Region | 0.2 |

| BA Continuum India Pvt Ltd | Mindspace Madhapur | Hyderbad | 0.1 |

| Mindtree Limited | Mindspace Madhapur | Hyderbad | 0.1 |

| Others | 1.9 | ||

| Total | 4.1 |

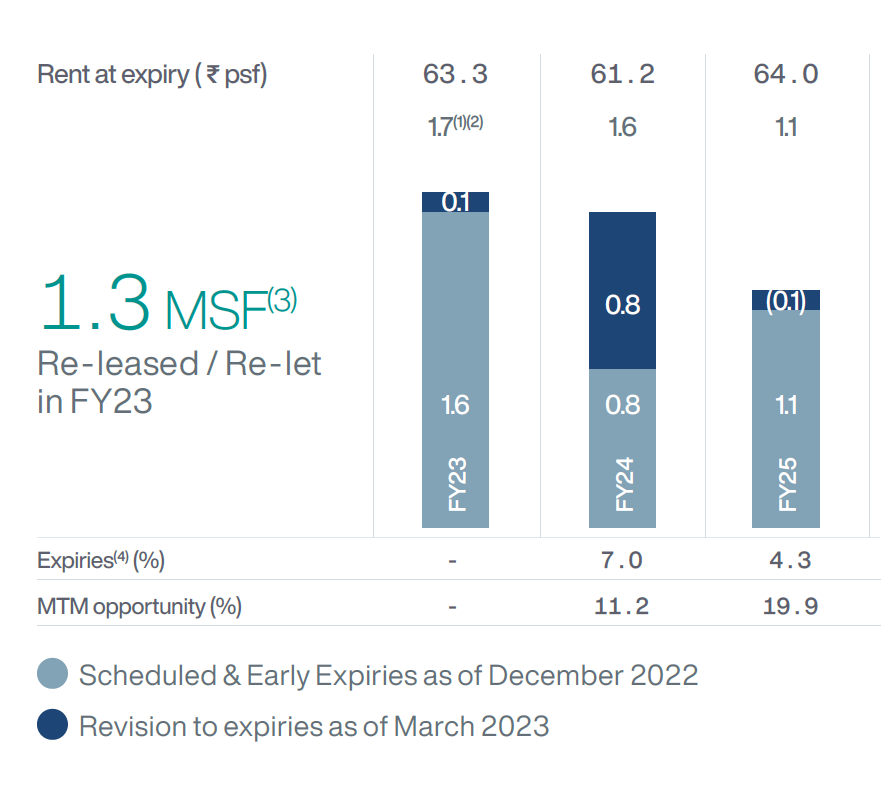

Lease Expiry Profile

Strong re-leasing achieved as macro environment continues to improve

Area expiry (msf)

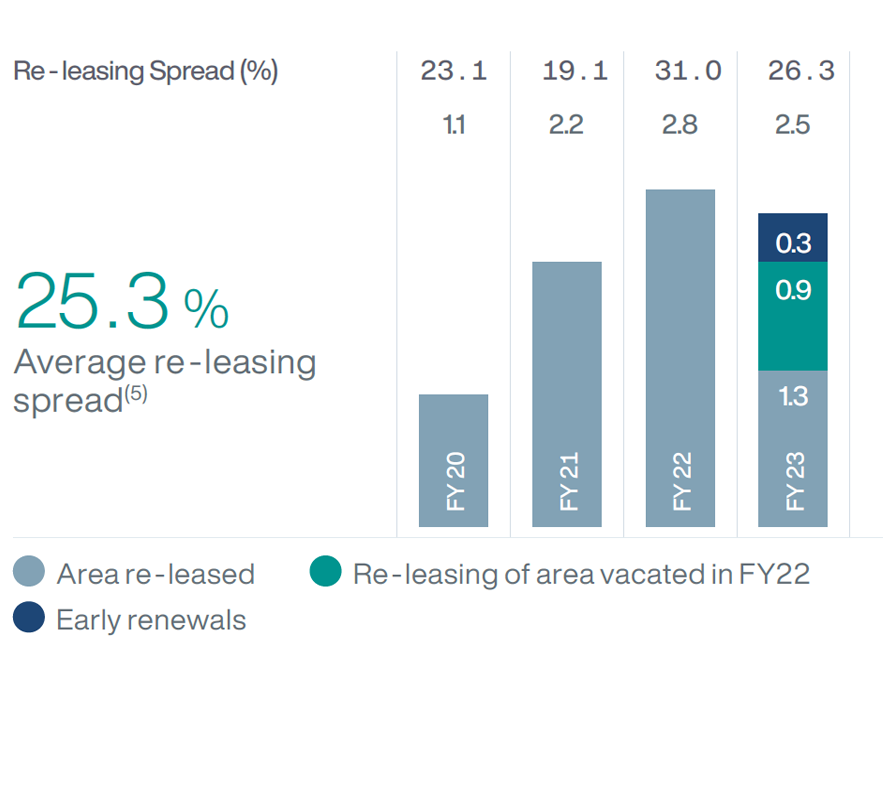

Track record of achieving re-leasing spread across parks

Area re-leased (since April 2019) msf

Notes:

- Impact of early termination of 90k sf; Excludes LOI Cancellation of 465k sf at Kharadi, Excludes exit of 327k sf, since B7&8 is planned for redevelopment at Mindspace Madhapur

- Excludes early renewals of 0.3 msf during FY23

- Includes efficiency adjustment of (75 ksf)

- Gross rent as % of total rent of Completed Area as of Marchd 31, 2023

- Re-leasing spread includes spread on extensions and on leasing of vacant area

Area-wise leasing performance since listing

11.4 msf leased since listing, including 7.2 msf of releasing at 24.5% re-leasing spread

New area leased % split by area(1)

4.2 MSF

Leased to 86 tenants

Existing area re-leased % split by area(1)

7.2 MSF

24.5% re-leasing spread(3)

Note:

1. For the period September 30, 2020 – March 31, 2023; includes committed and pre-leased area.