INDUSTRY LANDSCAPE

Grade A office market overview

CY22 was the second best year in Indian office history in terms of gross and net absorption which grew by c. 49% y-o-y and c. 44% y-o-y, respectively. The leasing volume in Q1 CY23 was recorded at 12.8 msf, better than the quarterly leasing volumes of Q1 CY22.

The commercial office spaces in India have evolved from standalone strata sold units to modern business parks which offer amenities such as cafeterias, conference room facilities, and multi-purpose sports courts, among others. Post the pandemic, there has been a complete transformation of occupiers’ definition of Grade A assets. Occupiers are keen to be associated with single owner buildings that have the best health, wellness, and safety protocols. Many occupiers have a global mandate to shift to green buildings that adopt the best sustainability practices.

The resultant uptick in demand for Grade A assets is evident, with institutionally managed office spaces capturing significant percentage of the demand.

Return to office plans put in motion

Occupiers and employees alike have realized and acknowledged the benefits that in-person interaction brings. Consequently, there is a lot of emphasis from the top-most echelons to encourage employees to attend office few days every week to begin with and then ramp it up. They want to usher the returning employees to one of the best environments that fosters collaboration, augments innovation, and boosts productivity. Hence, there is increased focus on occupying premium Grade A office ecosystems.

Office demand recovery propelled by:

- Strong hiring by technology companies and GCCs over the past two years and their space take up not being commensurate with the hiring

- Companies starting to call back employees to office

- Preference of occupiers to operate from secured office environments with adequate health, safety and wellness protocols

- Shift from strata sold assets to quality, single owner Grade A properties

- Rise in demand for campus style developments

Presence in the best performing micro-markets

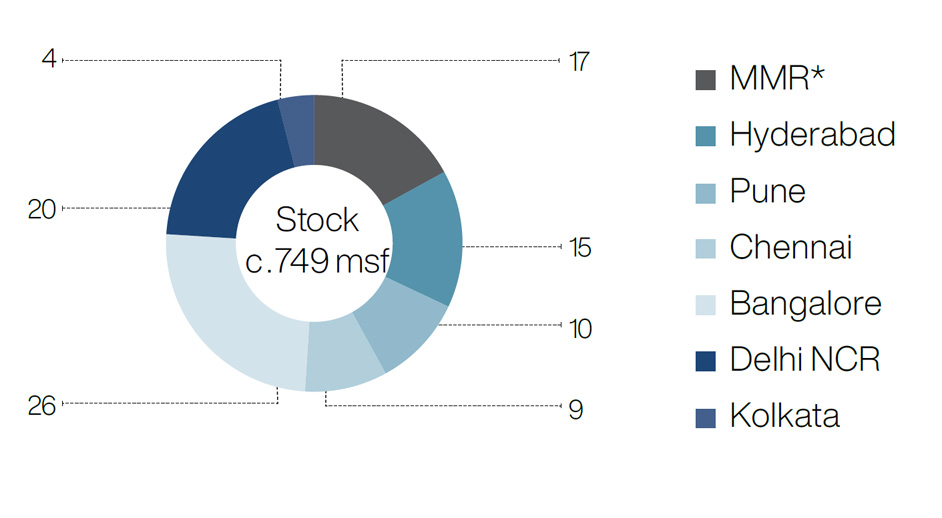

Top seven markets in India comprised c. 749 msf of Grade A completed stock as of March 31, 2023. Mindspace REIT is present in four of the top seven markets (Mumbai Region, Hyderabad, Pune, and Chennai). The net absorption during CY22 stood at 36.7 msf, and our micro-markets constituted 56.7% of the net absorption during the year. These cities have exhibited strong underlying growth fundamentals, such as economic and employment growth, diverse pool of tenants, educated workforce, robust transportation infrastructure, and favorable demand and supply trends.

Completed Stock for top 7 markets (%)

Source: Jones Lang LaSalle Inc.(JLL)

*Mumbai Metropolitan Region

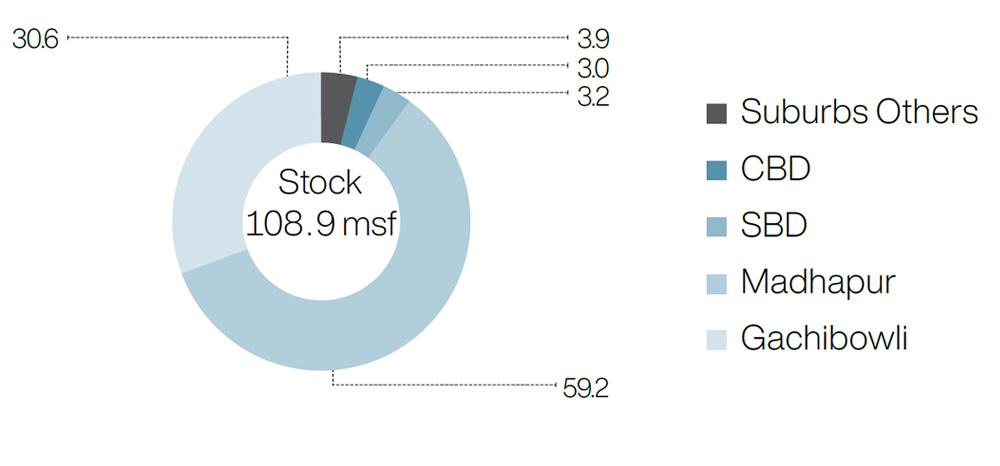

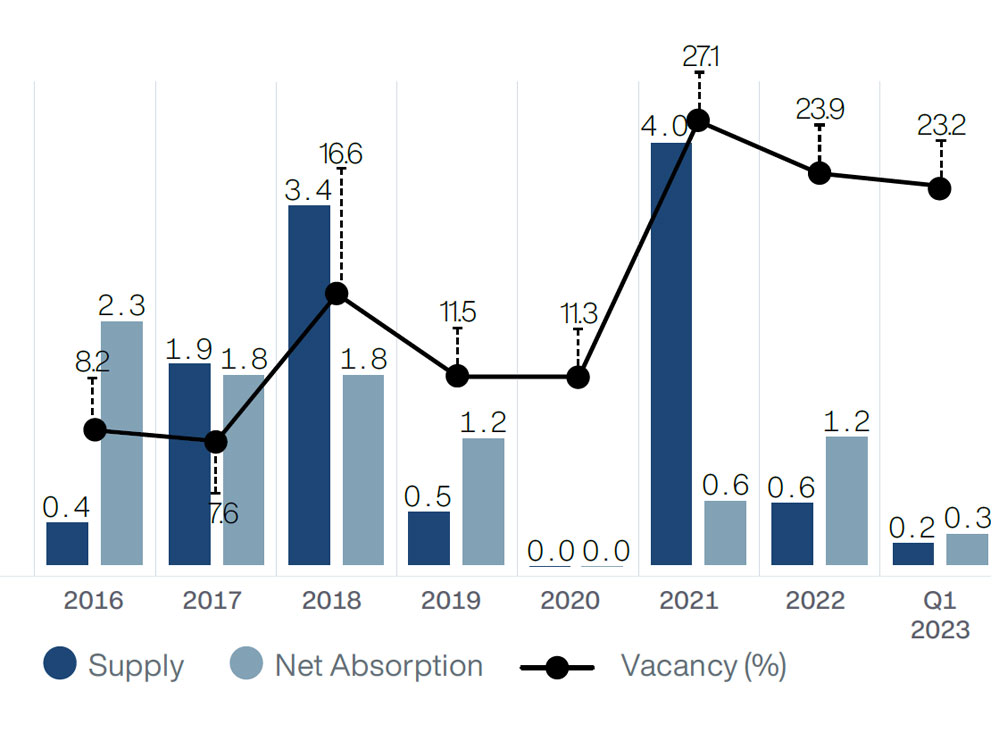

Hyderabad

Hyderabad is one of the fastest-growing cities in India. The city has succeeded in building on its IT/ITeS and pharmaceutical capabilities and managed to attract several global technology and pharmaceutical giants to invest in and operate from the city. The IT/ITeS and pharmaceutical industries are the two major sectors that contribute maximum to the city’s GDP. Proactive initiatives and investor friendly policies such as the new industrial policy of TSiPass by the state government has driven the fast and strong economic growth of the city over the last five years.

Completed Stock in sq ft (%)

Source: Jones Lang LaSelle Inc. (JLL)

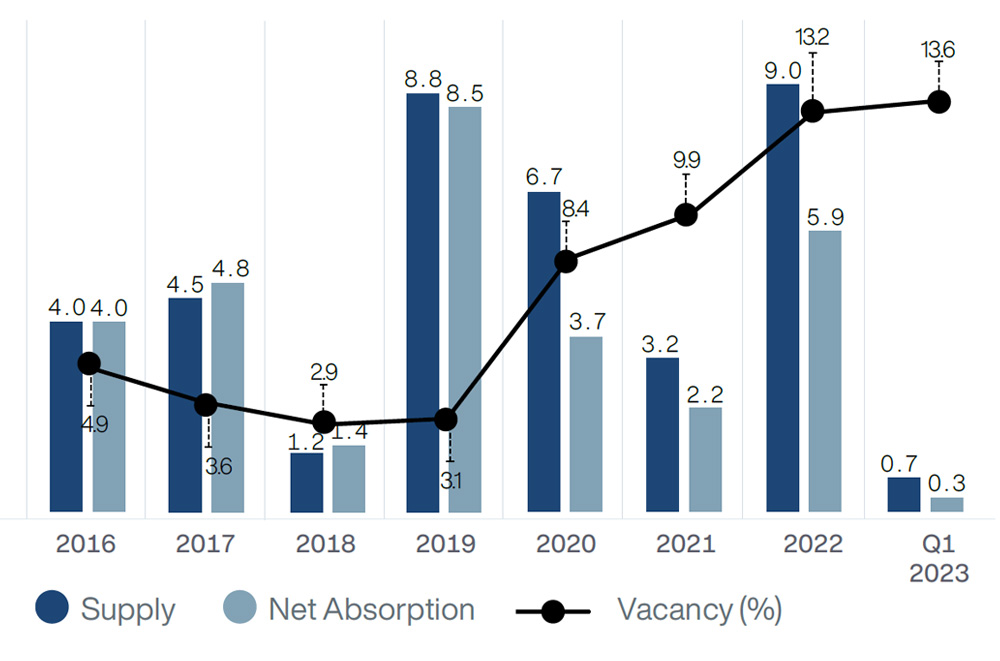

Key updates – Madhapur

Source: Jones Lang LaSelle Inc. (JLL)

- Madhapur is the most preferred micro-market in Hyderabad garnering nearly two-thirds of net absorption every year.

- Leasing activity in Madhapur has been largely driven by IT/ ITeS over the years. However, in the last couple of years, BFSI, co-working, telecom, and healthcare firms have also favored expanding their operations in the submarket.

- Rents in Madhapur have grown at a CAGR of c. 5.1% between 2016 and 2022.

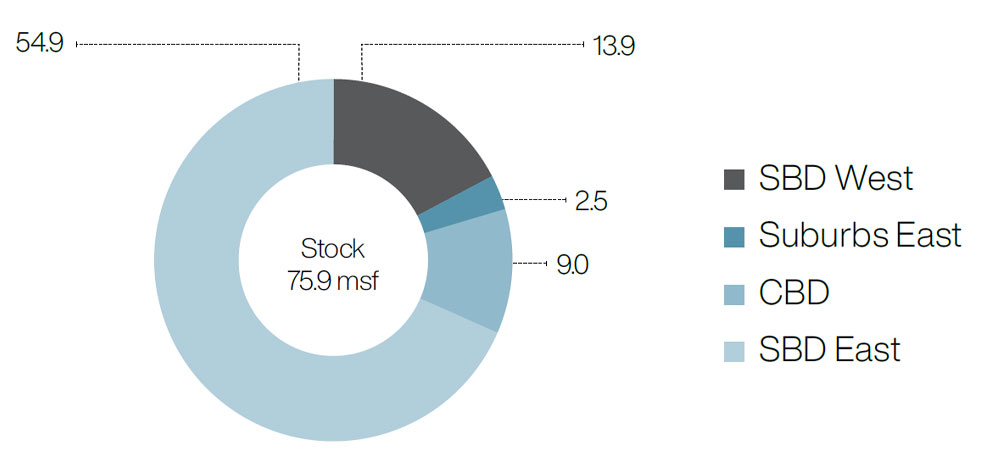

Pune

Pune has now been declared as the largest city in the state of Maharashtra in terms of geographical area coverage. The city has been a major educational hub since many decades having a presence of premium educational institutes in the country. Pune is also an important industrial hub having a presence of prominent foreign as well as domestic automobile, automobile ancillaries and electronics manufacturers. Attractive demographics and readily available skilled workforce have attracted corporates from various sectors like IT/ITeS, manufacturing, BFSI, consulting etc. to have their office in the city.

Completed Stock in sq ft (%)

Source: Jones Lang LaSelle Inc. (JLL)

Key updates – SBD East

Source: JLL and Wakefield Research

- SBD East has the largest share – c. 55% in the total Grade A stock of the city and has accounted for a 51% share of net absorption from 2016 till 2019 and has also recorded an even higher share of 57% in the post-COVID period.

- SBD East has consistently recorded lower vacancy levels than the city's average. Quality office parks, proximity to the city centre, support physical and social infrastructure, connectivity, and its evolution as a holistic work-play-live ecosystem has supported SBD East's continued strength as the premier office market corridor.

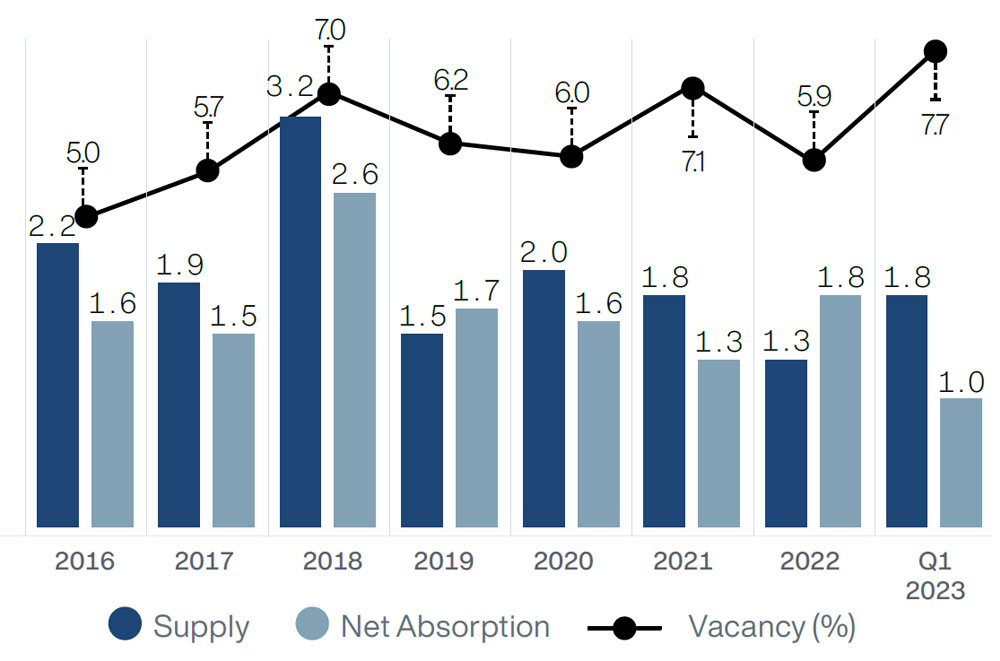

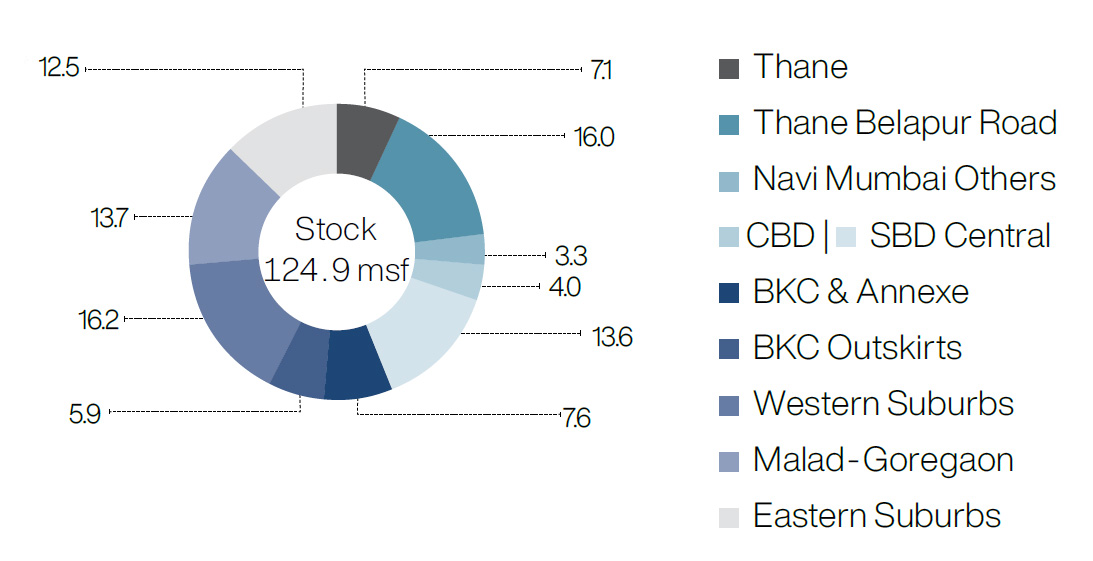

Mumbai Region

Mumbai is the financial capital, an economic powerhouse, and one of the key industrial hubs of India. It is also one of the most expensive real estate markets in India, with rents and capital values in the key office sub-markets being the highest in the country.

Completed Stock in sq ft (%)

Source: Jones Lang LaSelle Inc. (JLL)

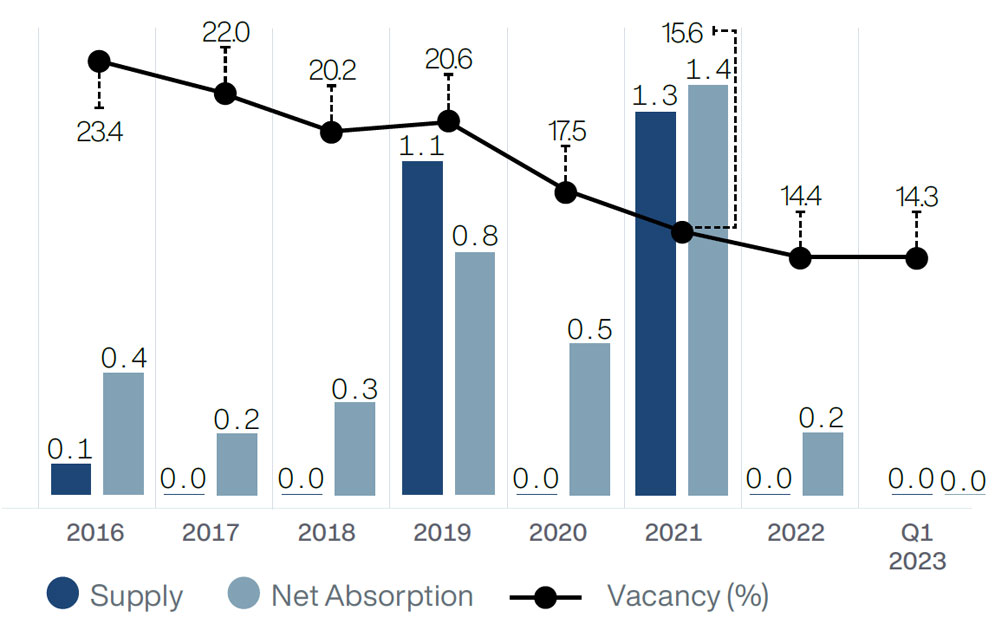

Key updates - Thane Belapur Road

Source: Jones Lang LaSelle Inc. (JLL)

Thane Belapur Road

- In the Thane Belapur market, quality institutional assets have enjoyed strong occupancy levels and strata-titled projects are major contributors to headline vacancy.

- The IT/ITeS tenants accounted for a major chunk of the leasing activity in the past five years in the Thane-Belapur market. Recently, BFSI and co-working operators have been quite active.

- Thane-Belapur Road has witnessed strong demand from IT/ITeS companies and BFSI back offices as they require larger office spaces at relatively cheaper rents.

- Vacancy in the micro-market is largely on account of SEZ properties.

Key Updates - BKC and Annexe

Source: Jones Lang LaSelle Inc. (JLL)

BKC and Annexe

- BKC and Annexe remains the premier front office submarket in Mumbai.

- Limited supply and robust space take-up has ensured that vacancy levels have now dropped down to single digits and vacancy remains extremely limited in quality assets.

Key updates - Malad – Goregaon

Source: Jones Lang LaSelle Inc. (JLL)

Malad – Goregaon

- Quality social infrastructure, improving connectivity through the operational metro lines, and competitive rentals make Malad-Goregaon a major office corridor for global occupiers.

- The strong demand and low relevant vacancy have combined to push up the average rents.

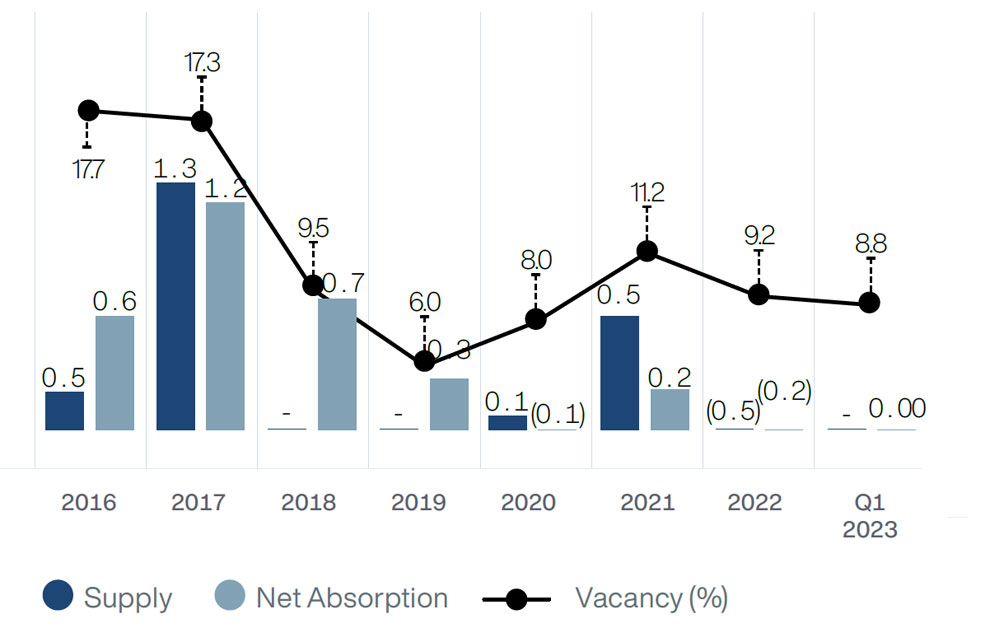

Chennai

Chennai is the fourth-largest metropolitan city in India. The rapidly evolving real estate sector is benefiting from the strong growth of the IT and Manufacturing industries and improving infrastructure. The city is culturally diverse and socially cosmopolitan.

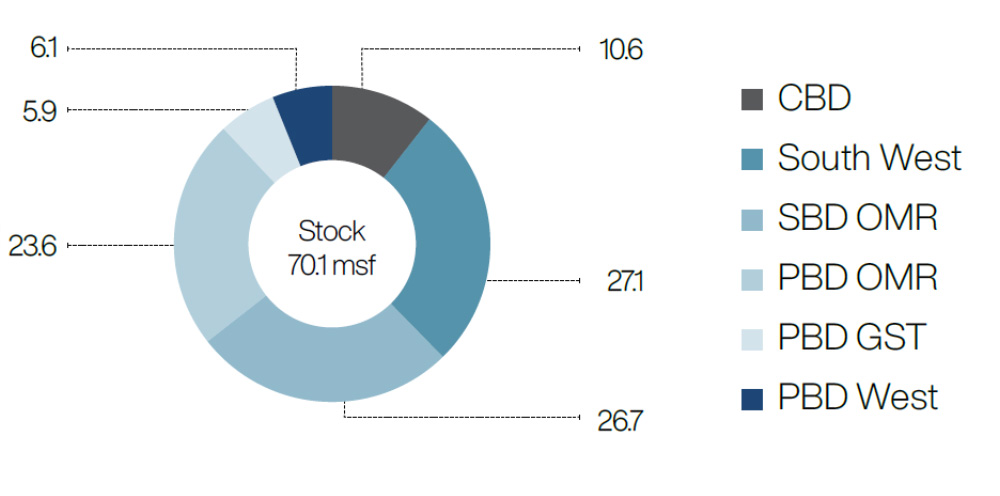

Completed Stock in sq ft (%)

Source: Jones Lang LaSelle Inc. (JLL)

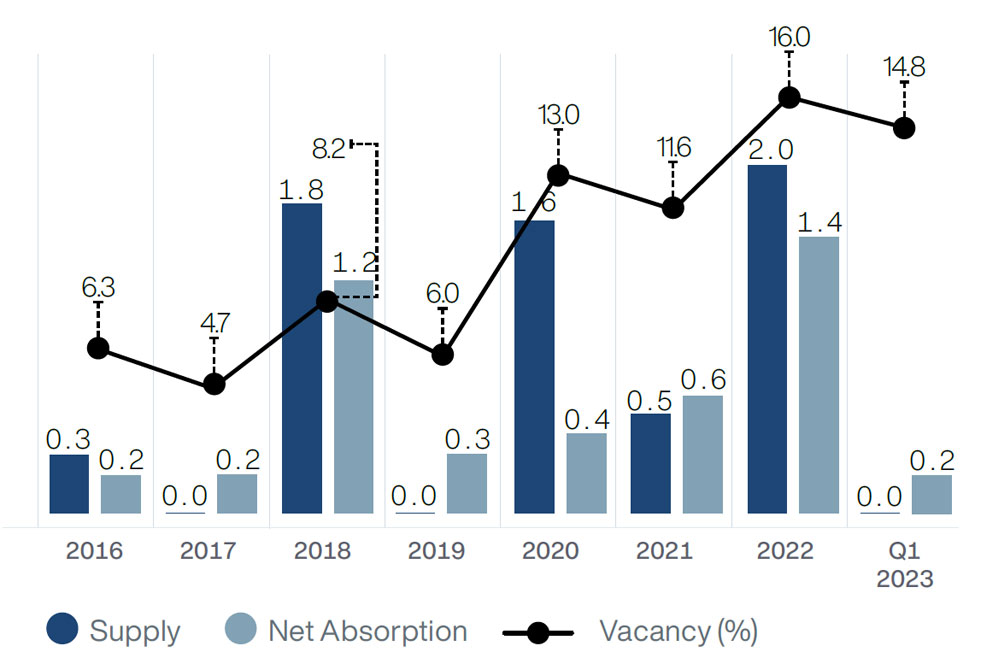

Key updates – South West

Source: Jones Lang LaSelle Inc. (JLL)

South-West

- The South-West market accounts for c. 27% share of the operational Grade A stock in Chennai

- The South-West market has clocked an average 19% share of net absorption from 2016 to 2019. In the post-COVID period, it has accounted for a 31% share of net absorption as quality projects have found takers from global occupiers.

- The South-West market has been dominated by IT/ ITeS occupiers in terms of share of leasing activity, but in more recent times BFSI occupiers, particularly GCCs and consulting firms along with manufacturing companies have scaled up.