Continuous engagement with investors

| Sr. No. | Conferences |

|---|---|

| 1. | Participation in Kotak - Chasing Growth 2022 Conference |

| 2. | Participation in Axis CapitaI India Conference |

| 3. | Participation in IIFL's Enterprising India Conference |

| 4. | Participation in Jefferies India Housing Real Estate Summit |

| 5. | Meeting with Investors during Roadshow |

| 6. | Participation in Morgan Stanley's Twentieth Annual Asia Pacific Summit |

| 7. | Participation in BofA Securities 2021 Global Real Estate Conference |

| 8. | Participation in 28th Annual CITIC CLSA Flagship Investors’ Forum 2021 |

| 9. | Participation in ICICI Securities Virtual ESG Conference |

| 10. | Meeting with Investors during Non-deal Roadshow |

| 11. | Meeting with Investors during Debt Roadshow |

| 12. | Participation in Morgan Stanley Virtual India Summit 2021 |

| 13. | Participation in BofA - APAC Financial, Real Estate Equity and Credit Conference 2021 |

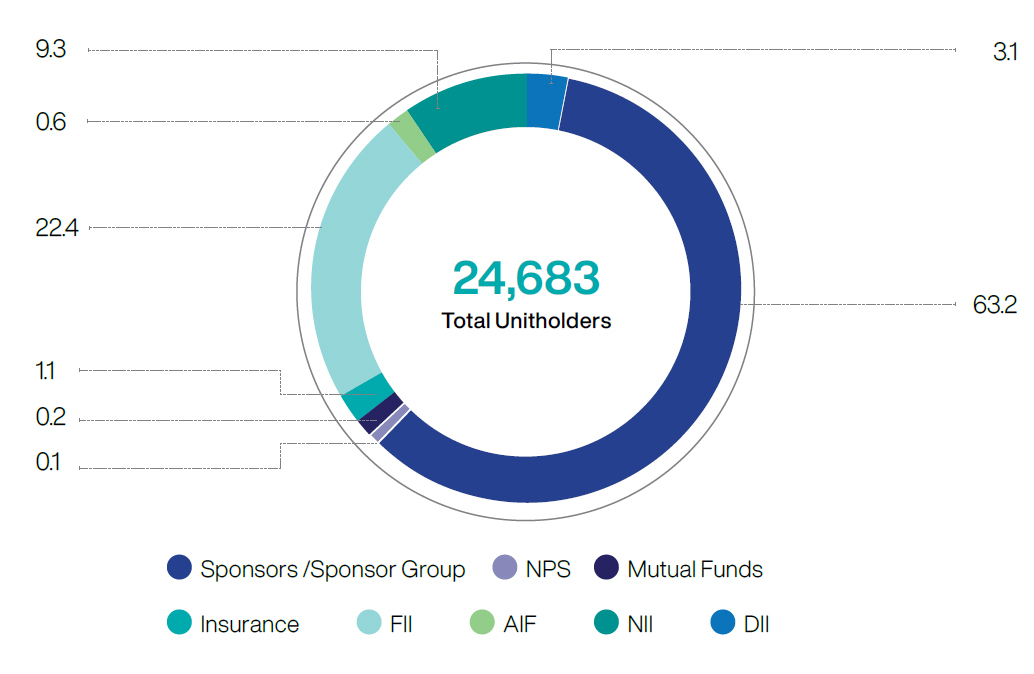

Unitholding Pattern as on March 31, 2022 (%)