EVOLUTION OF INDIAN OFFICE MARKET

| Period | Pre-2000 | 2000-2007 | 2008 onwards |

|---|---|---|---|

|

|

|

|

| Key tenants |

|

|

|

| Building type |

|

|

|

These new-age parks offer amenities such as cafeterias, conference room facilities and multi-purpose sport courts, among others. We also see the focus shifting to developing sustainable workspaces which are equipped with stringent safety norms. Due to better amenities for occupiers and scalability options, the larger campuses tend to command a premium over standalone buildings and enjoy a higher and more stable occupancy and attract superior tenants and are also preferred by the millennials.

The office market in India is driven by access to cost-effective, English-speaking, skilled labor at unmatched scale. The office market comprises various sub-segments such as IT, commercial and Special Economic Zones (SEZs).

EVOLUTION OF INDIAN OFFICE MARKET

| Period | Pre-2000 | 2000-2007 | 2008 onwards |

|---|---|---|---|

|

|

|

|

| Key tenants |

|

|

|

| Building type |

|

|

|

India accounts for 45% of Global GCCs

GCCs

Lower cost structure than US Tier-II cities

Source: India Commercial Real Estate Overview report by Cushman & Wakefield dated June 08, 2020 and May 04, 2021.

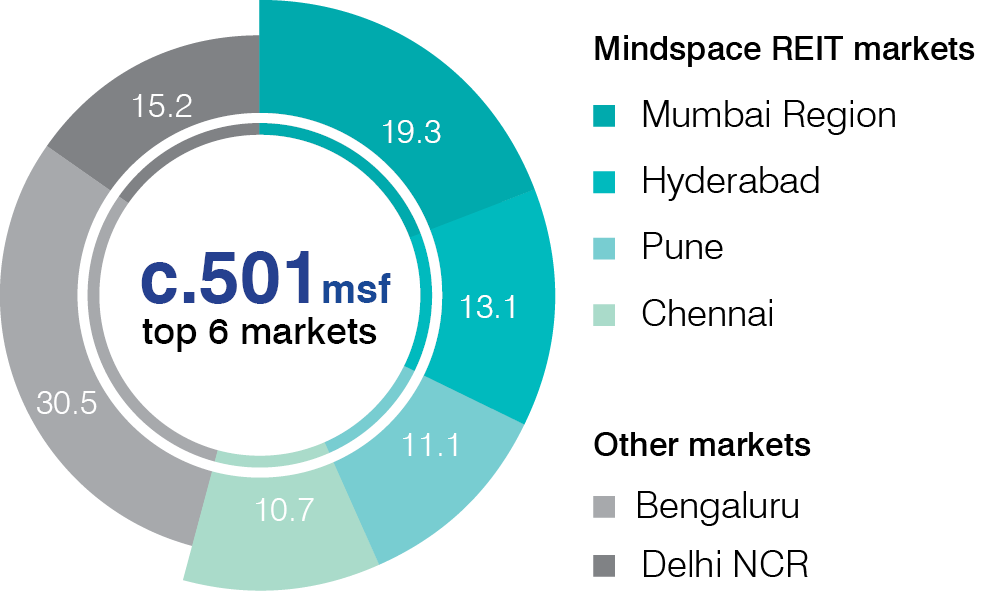

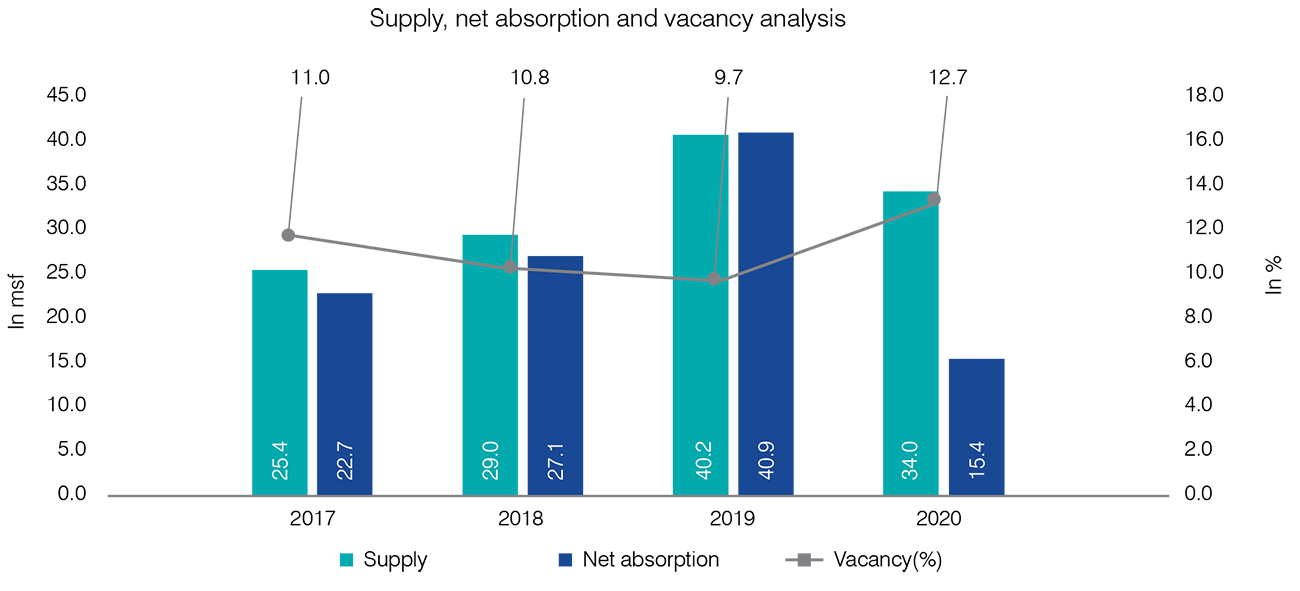

PRESENCE IN BEST PERFORMING MICRO MARKETS

Top six markets in India comprised c. 501 msf of Grade A completed stock as of December 31, 2020. Mindspace REIT is present in four of the top six markets (Mumbai Region, Hyderabad, Pune and Chennai). Net absorption during CY20 stood at 15.4 msf, our micro-markets constituted 61.9% of the net absorption during the year. These cities have exhibited strong underlying growth fundamentals such as economic and employment growth, diverse pool of tenants, educated workforce, robust transportation infrastructure and favorable demand and supply trends.

COMPLETED STOCK FOR TOP 6 MARKETS (%)

TRENDS IN TOP SIX INDIAN MARKETS

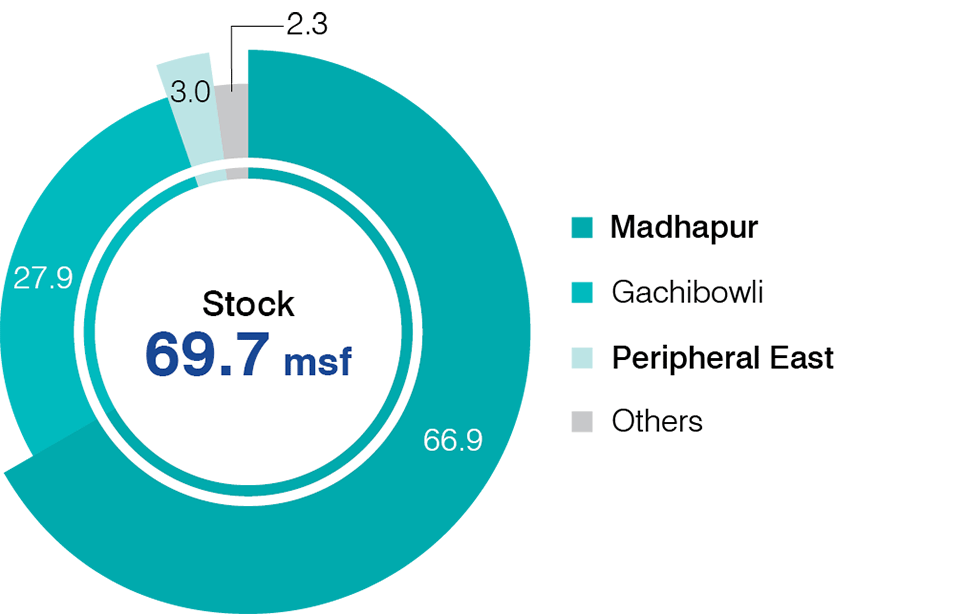

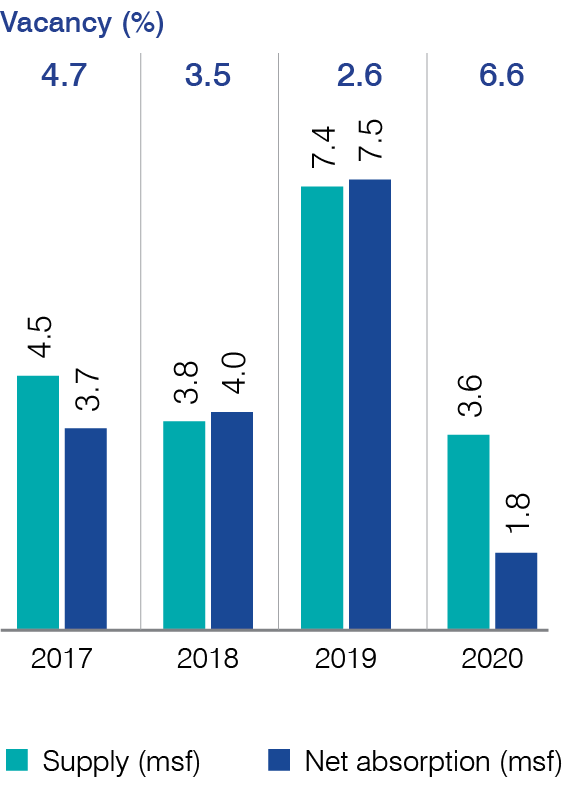

HYDERABAD

The growth in Hyderabad city’s economic base (primarily establishment of technology sector) has altered the real estate dynamics in the city. Positive commercial outlook of the city, expansion of existing tenants within the city and entry of new tenants during 2015- 2019 has led to compression in vacancy levels. The technology and financial services sectors are the key demand drivers.

COMPLETED STOCK (%)

Peripheral East: Pocharam and Uppal

Others: Kukatpally, Shaikpet, Towlichowki, Shamshabad

Note: The highlighted areas denote Mindspace REIT micromarkets

KEY UPDATES

Madhapur

Mindspace REIT assets

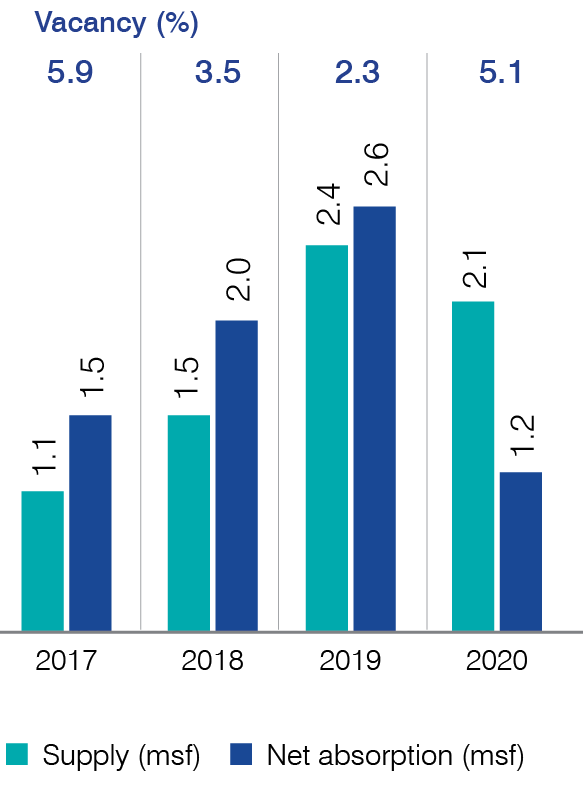

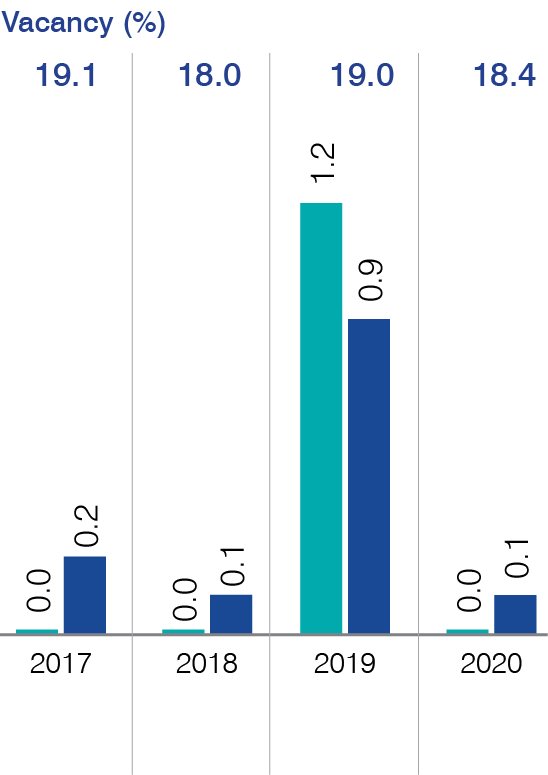

PUNE

Over the past decade, there has been an influx of IT companies which has changed the face of the city. Also, over the past 2 years, there has been an increase in the number of financial technology firms expanding their base in the city. The key drivers for the market include good quality offices, educated workforce and well-developed social infrastructure.

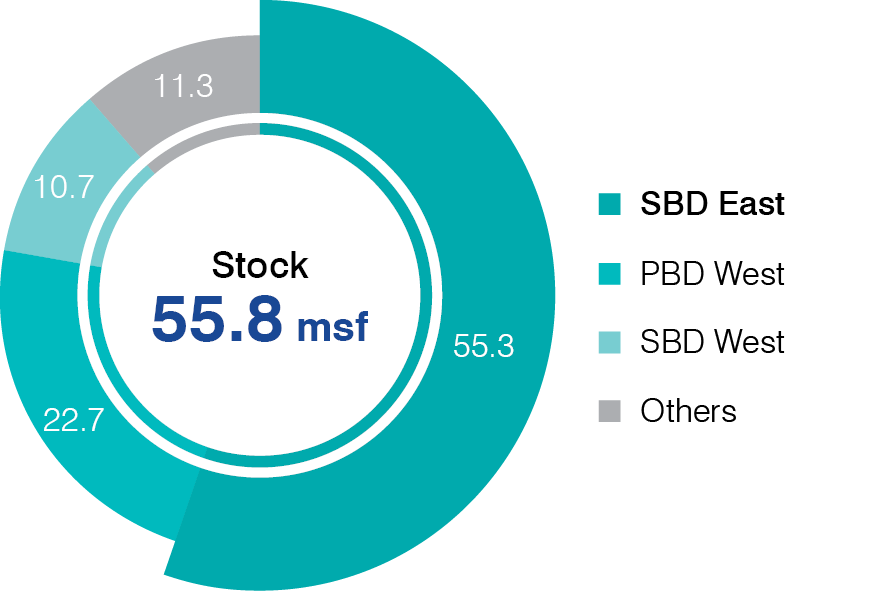

COMPLETED STOCK (%)

SBD East:Kalyani Nagar, Kharadi, Viman Nagar, Hadapsar

CBD: Shivaji Nagar, SB Road, Bund Garden, Koregaon Park, Camp, Boat Club

SBD West: Baner, Balewadi, Aundh, Bavdhan, Kothrud

PBD East: Khondwa, Fursungi, Wanowari

PBD West: Hinjewadi, Chinchwad, Wakad

Note: The highlighted area denotes Mindspace REIT micromarket.

KEY UPDATES

SBD East

Mindspace REIT assets

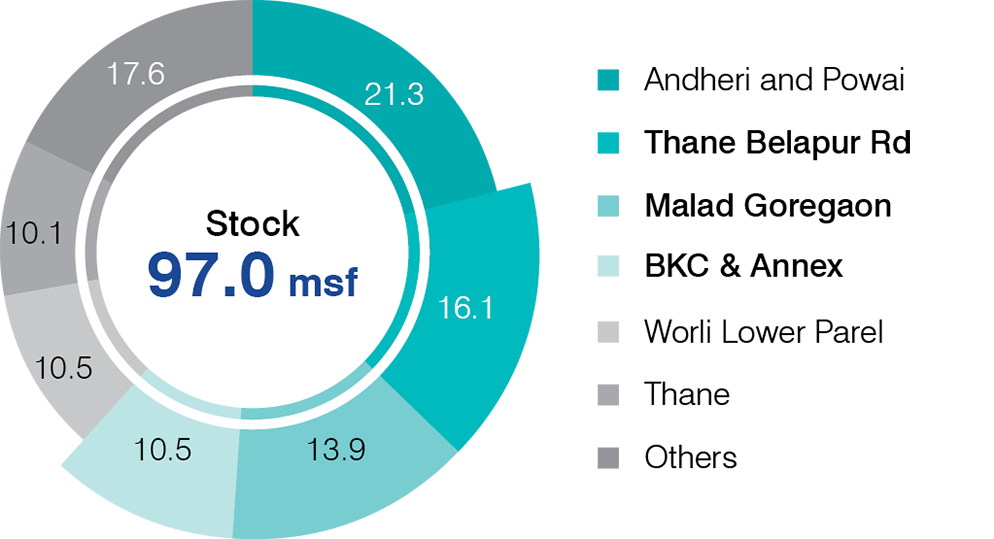

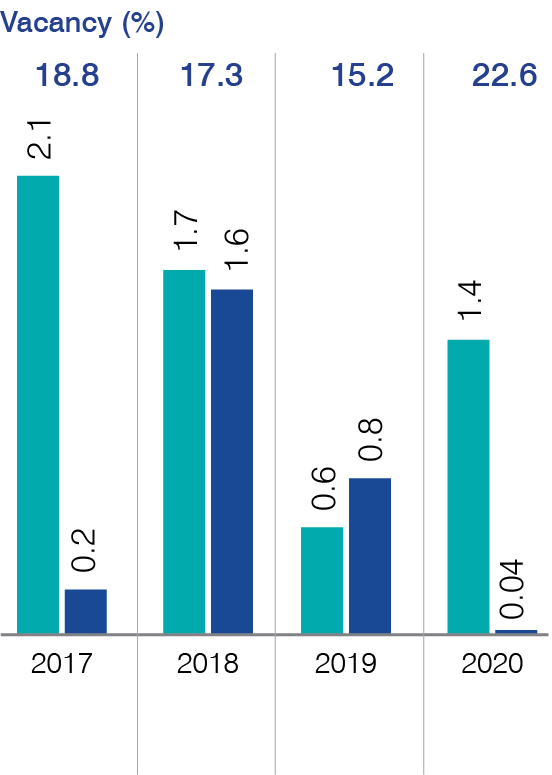

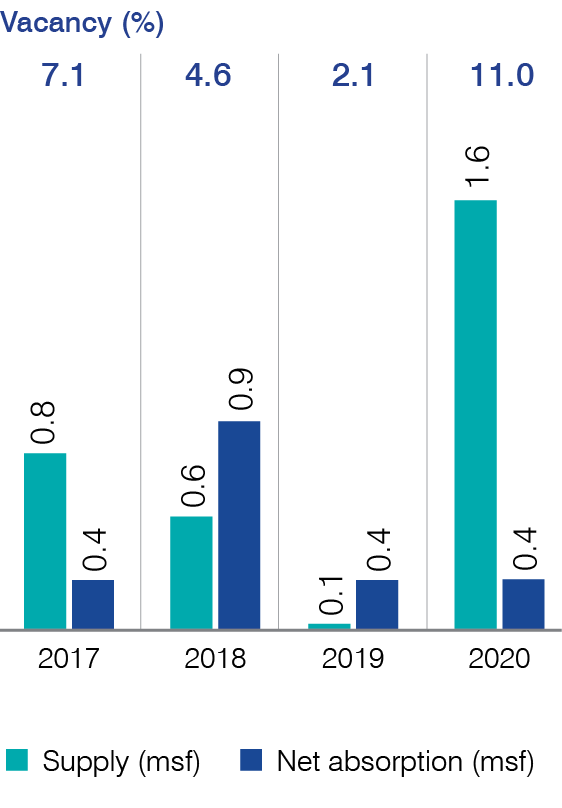

MUMBAI REGION

Mumbai is India’s financial and commercial capital. The presence of vibrant capital and money markets makes the city the first choice of entry for financial services firms. It is also a hub for global in-house centers (GICs)/ captive centers (GCCs) of many investment banks. The technology and financial services sectors are the key demand drivers.

COMPLETED STOCK (%)

Eastern Suburbs: Vikhroli, Kanjurmarg, Bhandup, Mulund

Central Suburbs:Sion, Chembur, Wadala, Kurla

Note: The highlighted areas denote Mindspace REIT micromarkets.

KEY UPDATES – MICRO-MARKETS

Thane Belapur Road

Malad – Goregaon

BKC and Annexe

Mindspace REIT assets

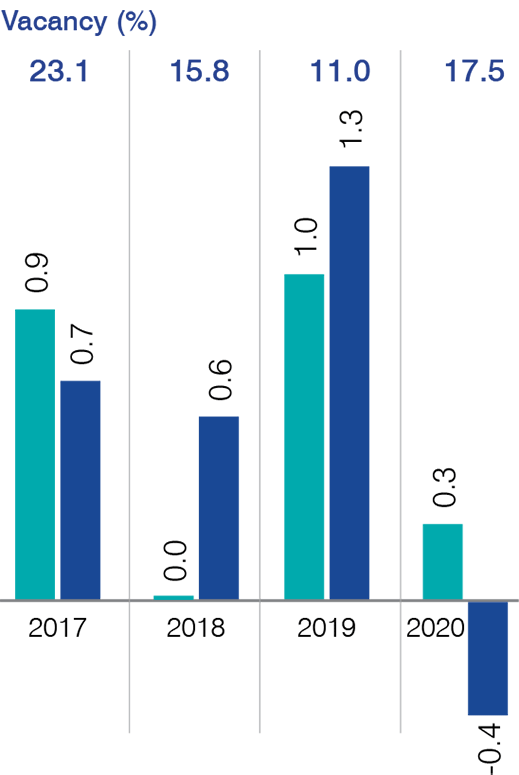

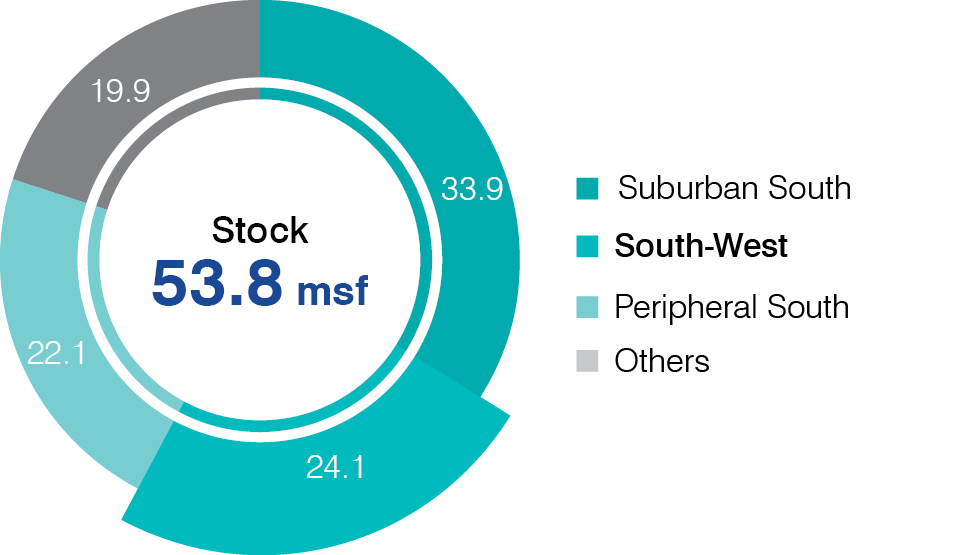

CHENNAI

Demand for commercial office is mainly driven by the technology, Banking, Financial Services and Insurance (BFSI) and healthcare and pharmaceutical sectors. Other demand drivers include skilled talent pool and established institutions, and well-developed social infrastructure

COMPLETED STOCK (%)

CBD:Anna Salai, Nungambakkam, RK Salai

Off-CBD: T.Nagar, Alwarpet, Kilpauk, Egmore, Chetpet, Royapettah, Kotturpuram

Peripheral South: Sholinganallur, Thoraipakkam, Navalur, Siruseri, Padur

Suburban South: South: Perungudi, Taramani, Thiruvanmiyur, Velachery

South West: Guindy, Ashok Nagar, Vadapalani, Manapakkam, Ekkaduthangal, Porur

North West: Ambattur, Padi, Annanagar, Koyambedu, Arumbakkam

Peripheral South-west: Singaperumalkoil, Tambaram,Guduvanchery,Perungalathur, Pallavaram, Pallavaram Thoraipakkam Corridor, Pallikaranai

Note: The highlighted area denotes Mindspace REIT micromarket.

KEY UPDATES

South West

Mindspace REIT assets

LONG-TERM FUNDAMENTALS OF THE OFFICE INDUSTRY REMAIN INTACT

Short-term headwinds

Deferment of large consolidation

Demand uncertainty to continue for 3-4 quarters

Higher focus on health and safety measures

Gradual recovery expected in leasing activity

Construction delays, limited access to capital to affect future market supply

Rentals broadly estimated to remain unchanged

Source: India Commercial Real Estate Overview report by Cushman & Wakefield dated May 04, 2021.

Medium- to long-term recovery

Preference to operate from secured office environments

Global business relocation due to cost advantages and availability of talent pool

Shift to Grade A assets with campus styled development, high on COVID-19 and other health and safety protocols

Upward rental movement expected with a more sustained return of demand